Allied Premium Insurance Blog |

|

An essential way to improve your overall wellness is to practice good vision and oral habits. Having insurance on both helps promote preventive care. More importantly, having a routine eye and dental exam may help decrease the chance of making several claims from costly insurance plans.

0 Comments

Our teeth serve a crucial role in our body as they help us chew the food we eat. Tooth decay results from not having good dental hygiene and can affect other parts of the body.

It take time and care to achieve healthy teeth. You need to do the right thing in taking care of them. The following are some steps you can take to achieve healthy teeth: Critical insurance is a long-term cover that insures against serious diseases mentioned in the coverage. If a policyholder experiences any of the insured illnesses, they’re eligible for a tax-free, one-time payoff. With this, they can cover property mortgages, rental fees, outstanding debts, or renovations to add wheelchair access if necessary.

In the world of what-ifs, it's smart to have insurance for every member of your family. Ideally, you want group insurance that will cater to every family member's health needs, including emergencies, specialist coverage, medical coverage, wellness checkups, and more. And with the numerous health insurance companies in the market, how can you tell which one fits your family's needs?

The novel coronavirus is now having a major impact on our daily lives. But it's not all bad, individual states are starting to issue emergency orders to major insurance companies to waive coronavirus testing fees. The Centers for Disease Control and Prevention has announced that testing is now available in all 50 states. This week Lab Corp. also announced it was offering free tests and Quest Diagnostics has begun testing samples. Your plan will likely cover testing for the virus if you have health insurance. States like Washington and New York have requested insurers to also waive copayments or deductibles for coronavirus testing. Here is a list of some of the major health insurers covering coronavirus testing and treatment:

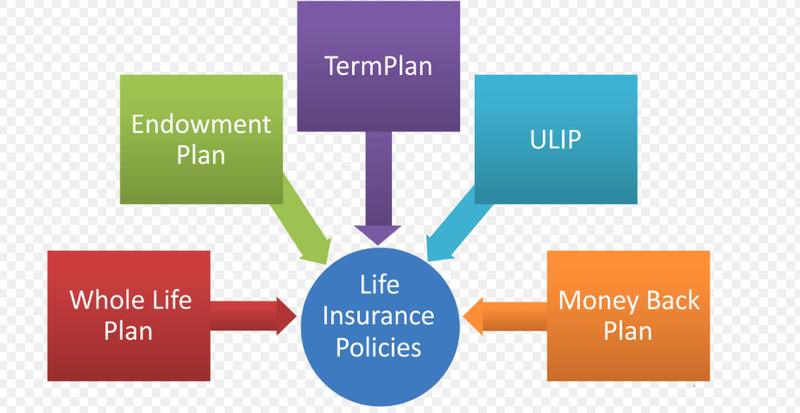

Life insurance pays out a sum of money either on the death of the insured person or after a set period of time. Types of Life Insurance Policies:Term Life Insurance

Different Types of Healthcare Plans Different types of health insurance plans meet different needs. When you compare options, it's important to understand some of the ways plans are structured. Health Maintenance Organization (HMO) This type of health plan only covers services from a network of doctors in your area. With some HMO plans, you'll need to choose a main doctor, also called a primary care physician (PCP), from the HMO network. Your PCP helps you manage your care. If you need a specialist, you'll most likely have to go through your primary care doctor to get a referral. Preferred Provider Organization (PPO) These insurance plans give you a choice of getting care within or outside of a provider network. You may use out-of-network providers and facilities, but you‘ll have to pay more than if you use in-network ones. If you have a PPO plan, you can visit any doctor without a referral. Higher Deductible Health Plans (HDHP) If you think you won‘t use that much health care next year, you could get a plan that may cost less per month with a higher deductible. And we also cover some of the basics at no extra cost — like checkups and other preventive care. Catastrophic Plans People under 30 and people with certain financial limitations may buy a "catastrophic" health plan. It‘s called catastrophic because it protects you if you end up with some really large medical costs due to an unexpected illness or accident. These plans often require that you pay all of your medical costs up to a certain amount, usually several thousand dollars — although some also cover some preventive care like checkups. Exclusive Provider Organization (EPO) This type of plan has a select network of care providers. Except in an emergency, you would only get benefits from an in-network provider. With an EPO, you can see an in-network specialist without a referral from your primary care physician. Point of Service (POS) This type of plan allows you to go outside the network for non-emergency care, but may result in a lower level of benefits being paid by the plan. https://www.apinsuranceagents.com/featured-plans.html  Welcome to our new insurance agency blog! This is our very first post. We're not quite sure what we're going to write about here, but the plan is to create helpful content for customers and prospective clients about information that is relevant to you. We hope you'll come to view this as a top resource for keeping your family and your finances safe. Here are a few of the topics we may be writing about:

Stay Tuned! |

Contact Us(888) 294-8434 Archives

December 2022

Categories

All

|

RSS Feed

RSS Feed